Friends, we hear a lot of negativity when its about real estate, especially when it’s all about documentation which plays a vital role in appreciating or depreciating your investment. So today I am going to give you a complete detail on what exactly on the documentation you have to look at before putting your hard earned each penny. And for this you need a good Advocate who can give you in depth history of the property. Always understand the history of the property along with getting an opinion of it from an advocate.

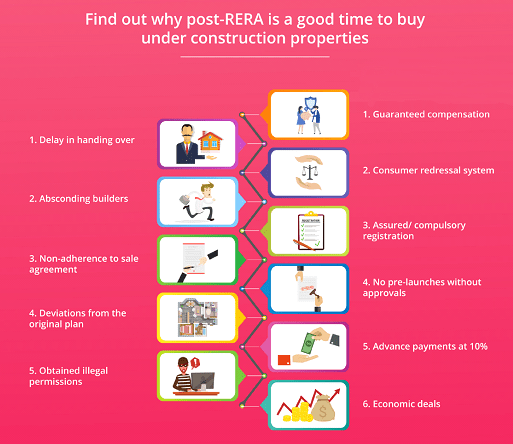

Firstly, always look for a project which is always RERA approved and Bank Approved. When I say RERA approved, these are the projects which has got DC Conversion, Plan approval of project from concerned planning authority, A-Khatha/E Khatha(9&11A) and also title is in the name of the seller. When it is Bank approved then it is clear that it’s a translatable property in future too.

Why we should invest in RERA approved or Plan approved projects and not Revenue sites (Panchayat) is because these sites are not authorized by any planning approval authority which gives free hand to State and National Govts to acquire your property and give compensation on the value of the Agricultural land. It wont hold the market value of a site or plot so it’s a big loss and the basic facilities for the same plots may take years or even a decade to get basic facilities like water connection or sanitary line which is very important facility. If you ask whether the plan approved projects can not be acquired by any govt authority then it’s not true. But still you have an upper hand because such properties can be acquired by only National Highway Authoritied of India (NHAI) for road widening only and no other department like Housing Board or Industrial Board can even think of acquiring it. And if it’s getting acquired by NHAI then you can claim for actual market value as compensation which is your right.

When I say Bank approval, it is because these properties having loan facility states that in future for any kind of financial help you can approach those banks for loan or when you are selling the same property, you can refer to the buyer which will be easier for him to get loan.

Always take a copy of legal document set of property and get it verified by your advocate. Whichever advocate is verifying always tell him to check the property flow of title of minimum 50 years or more only. Normally some prefer to do only 30 years, which I wouldn’t recommend. Accumulate few of the necessary documents from govt revenue offices by your advocate only to cross verify the legality of documents. Make sure you get to see the original documents once along with your advocate of the property. Because it is a project, these documents will not be provided to customers/buyers except there own sale deed, khatha copy.

So these are the basic things you need to follow when you are buying a plot/site in a project. Please feel free to ask me your queries in comments section. I will try to answer them as much as I can. You can even email me at spankajbalar@gmail.com

Thank you & Invest safe,

Pankaj Kumar